| Full Name | Equity Bank (Kenya) Limited |

| Website | equitygroupholdings.com |

| Services Offered | – Banking Services (checking, savings, loans) – Investment Services – Insurance – Digital Banking – Money Transfer |

| Ownership | Publicly traded company under Equity Group Holdings Plc |

| Location | Headquartered in Nairobi, Kenya |

| Contacts | Customer service: +254 763 000 000 Email: [email protected] |

| Equity Bank Facebook | |

| Equity Bank Twitter |

From a small, struggling building society in the early 1980s, Equity Bank has grown into a powerhouse with a presence in six countries, and serving millions of customers in Kenya and in East Africa.

The bank offers a wide range of services, including personal and business banking, microfinance, and insurance products. It has also been celebrated for its innovative approach to banking, and its role in fostering financial inclusion for the unbanked.

But who owns Equity Bank? Is it controlled by a single individual, or is the ownership more complex?

Let’s delve into Equity bank’s ownership, shareholding structure, and the key roles that notable figures like James Mwangi and Peter Mwangi have placed in the bank.

About Equity Bank

Equity Bank, headquartered in Nairobi, Kenya, operates under the umbrella of Equity Group Holdings Plc. The bank serves over 14 million customers across six countries: Kenya, Uganda, Tanzania, Rwanda, South Sudan, and the Democratic Republic of Congo.

It offers a wide range of services, including savings accounts, loans, investments, and digital banking solutions tailored to meet the diverse needs of its clientele.

Over the years, it has introduced products tailored to underserved populations, such as smallholder farmers and informal traders. Its innovative use of mobile and digital platforms has further cemented its position as a leader in the African banking sector.

What Does Equity Bank Do?

Equity Bank provides a comprehensive suite of financial services to individuals, small businesses, and corporations.

Its offerings include deposit accounts, credit and loans, insurance, and investment opportunities. The bank is also at the forefront of digital banking, enabling customers to access services conveniently through platforms like Equity Mobile and Equitel.

Beyond traditional banking, Equity Bank is known for its social impact programs. Through the Equity Group Foundation, it runs initiatives in education, health, agriculture, and entrepreneurship.

Programs such as Wings to Fly have helped thousands of bright, underprivileged students access quality education.

Who Are the Biggest Shareholders in Equity Bank?

Equity Bank is listed on the Nairobi Securities Exchange (NSE) and the Uganda Securities Exchange (USE), making it a publicly traded company. Its ownership is shared among institutional investors, retail shareholders, and a few prominent individuals.

Equity Group Holdings boasts a diverse shareholder base with over 28,000 shareholders. The largest shareholder is Arise BV, an institutional investor based in Norway and the Netherlands, holding approximately 12.76% of the shares as of 2024.

Following Arise BV is James Mwangi, the bank’s CEO and managing director, who owns about 3.39% of the shares. Other significant shareholders include Rabobank, Norfunds, International Finance Corporation, etc.

Other significant shareholders include pension funds, mutual funds, and individual investors.

Is Peter Munga the Owner of Equity Bank?

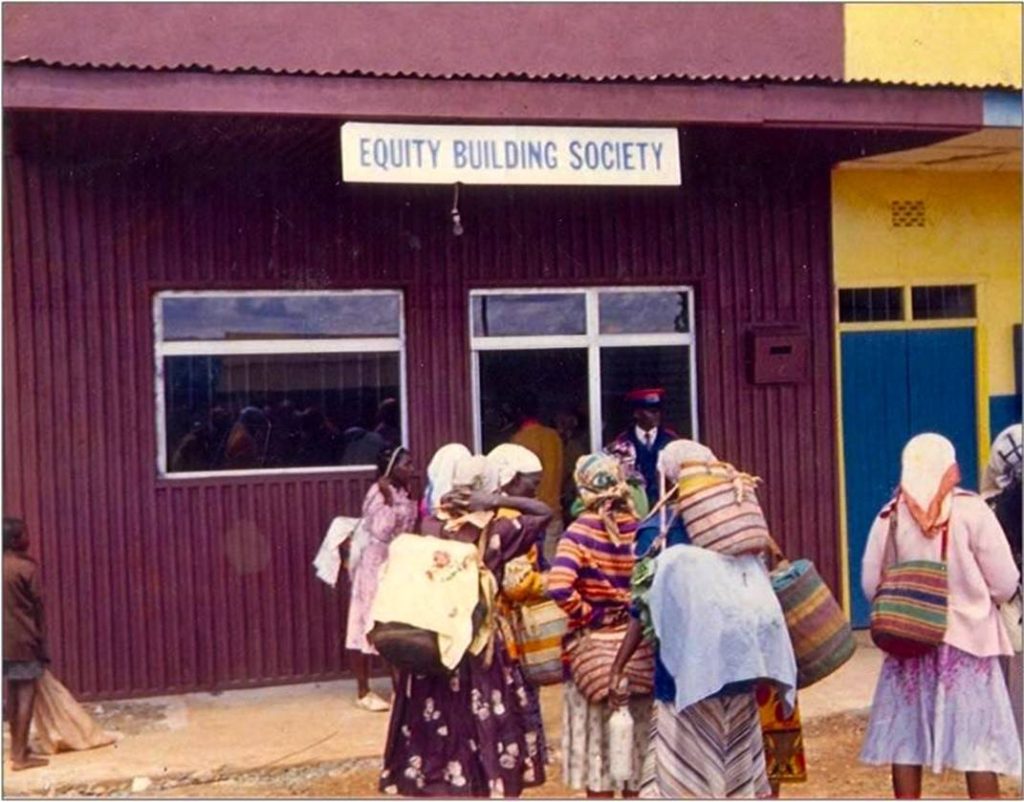

Peter Munga, a respected entrepreneur and philanthropist, is one of the founding figures of Equity Bank. He established Equity Building Society (EBS) in 1984 before it transformed into Equity Bank in 2004.

Munga played a crucial role during a critical period when EBS faced insolvency in the early 1990s. He served as the bank’s chairman for many years, leading it in its transformational journey from a small building society to a leading financial institution.

While Peter Munga holds shares in Equity Bank, he is not the sole owner. He no longer holds a controlling stake or operational role within the bank today, but his influence as one of the visionaries behind the bank’s success remains significant.

Peter Munga retired in 2018, after serving 35 years in Equity Group Holdings Plc.

Is James Mwangi the Owner of Equity Bank?

James Mwangi is not the sole owner of Equity Bank; however, he is one of its most influential figures.

As the CEO and managing director since 2004, Mwangi has been pivotal in transforming Equity from a struggling building society into a leading commercial bank. His leadership has been marked by strategic innovations that have significantly increased customer access to banking services.

Mwangi holds approximately 3.39% of Equity Group Holdings’ shares. His vision for inclusive banking has not only driven growth but also fostered a culture of entrepreneurship among East Africans.

Under his stewardship, Equity Bank has expanded its operations across six countries while maintaining strong financial performance.

Who is the CEO of Equitable Bank?

The current CEO of Equity Bank is Dr. James Mwangi, who has been at the helm since 2004, guiding the institution through various phases of growth and transformation.

Under his stewardship, Equity Bank has expanded its operations across East and Central Africa, becoming one of the largest commercial banks in Africa by customer base and assets.

Dr. Mwangi is widely recognized for his vision and leadership, receiving numerous awards, including the Ernst & Young World Entrepreneur of the Year in 2012.

History of Equity Bank (How It Started)

Equity Bank started in 1984 as Equity Building Society (EBS), a modest financial institution in rural Kenya.

Initially, its primary purpose was to offer mortgage services to low-income individuals. However, by the 1990s, EBS faced severe financial challenges, with insolvency looming. In 1993, Munga brought in James Mwangi’s, a fast rising accountant then, to help restructure EBS during this crisis.

By 1997, EBS had cleared its debts and transformed into a more robust institution capable of offering diverse financial products. By 2004, Equity Building Society had transitioned into Equity Bank Limited, a full-fledged commercial bank.

In 2006, Equity bank was listed on the Nairobi Securities Exchange (NSE), and it became the largest bank in the NSE by market capitalization.

Today, Equity Group Holdings continues to thrive as one of the largest players in the banking sector with the objective to enhance financial inclusion across East Africa.

![Who Owns Equity Bank? [Largest Shareholders] Who Owns Equity Bank](https://tribune.co.ke/wp-content/uploads/2024/11/Who-owns-Equity.jpg)