NBA Career

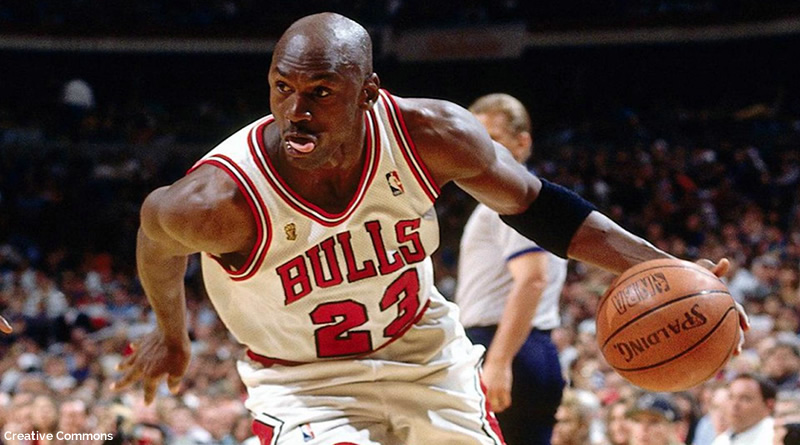

Michael Jordan, the first billionaire athlete, started his basketball career with the college basketball team while studying at the University of North Carolina from 1981 to 1984. He was then selected by the popular Chicago Bulls to play professional basketball in the national league.

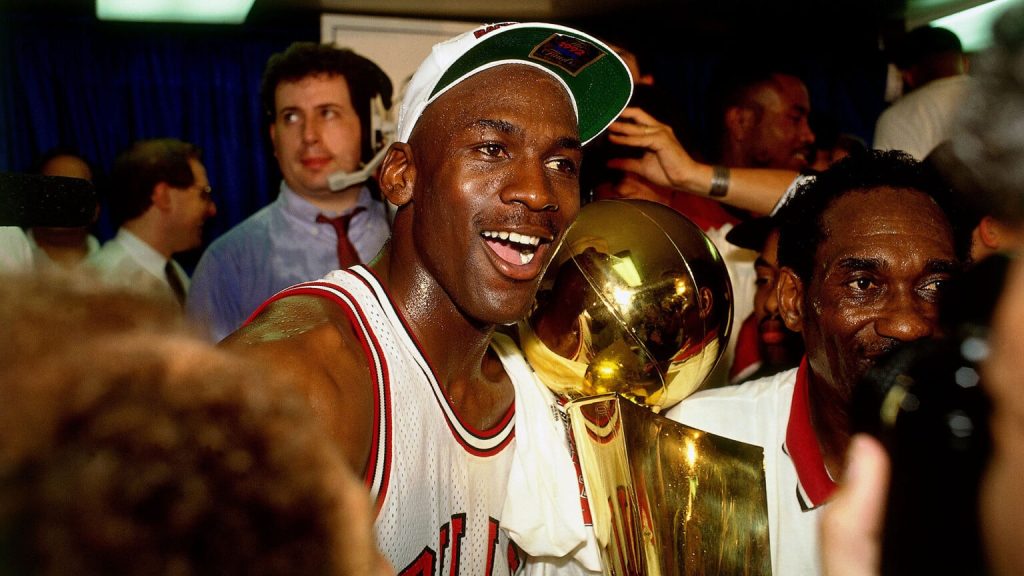

Since stepping onto an NBA court for the first time in 1984, Jordan has continued to earn an outsized paycheck. Thanks to his sale of the Charlotte Hornets, the NBA legend is smiling all the way to the bank—becoming the first professional athlete to rank among America’s 400 wealthiest people.

With a listed height of 6 ft 6 in (1.98 m) and a listed weight of 216 lb (98 kg), Michael Jordan has hauled in $94 million in salaries and endorsements, across his 15 NBA seasons, to become the league’s highest-paid player in 1997/1998 season.

Off the Court Earnings

Surprisingly, Michael is still putting serious air between himself and all the other athletes on the planet years after his retirement. With lucrative deals flowing in, his off-the-court earnings jumped to $2.4 billion (pre-tax). Jordan has signed endorsements with top brands like Nike, Gatorade, McDonald’s, Hanes, and Upper Deck, thus skyrocketing his most recent annual royalty earnings to around $260 million.

Michael Jordan had the biggest score when he sold his majority stake in the Charlotte Hornets at a staggering $3 billion valuation. Charlotte Hornets, the 27th-most-valuable franchise in the National Basketball Association (NBA), traded for the second-highest sale price in league history and almost 17 times higher its value when Jordan took over principal ownership in 2010.

That places him in the dollar billionaires’ club, marking the first time a professional athlete has ranked among America’s wealthiest individuals, with an estimated net worth of $3 billion, Michael Jordan has officially arrived on The Forbes 400 list.

Ted Leonsis, the Washington Wizards, Mystics, and Capitals owner, who partnered with Jordan on multiple investments and sports ownership, said in a statement, “Michael’s one of the few people that have had success three times, a lot of entrepreneurs, they make it once. They have a big win, take their winnings, retire, and [we] never hear from them again, or they try something a second time, and it doesn’t work, he’s had three mega-successes,” Leonsis, referring to Jordan’s impact as an athlete and businessman driving the success of Air Jordan brand at Nike.

Billionaire Athletes

The prospect of a professional athlete becoming a billionaire is still highly irregular; only three players have ever done it. Jordan was the first to achieve that milestone in 2014, while LeBron James and Tiger Woods have followed, doing so while their careers are still active. With sports salaries skyrocketing and off-pitch opportunities growing, more prospects are expected to follow, and the fact that seven athletes, by Forbes’ ranking, have already notched $1 billion in career earnings before taxes, spending, and agents’ fees.

Mark Cuban, the billionaire owner of the Dallas Mavericks, says, “Joining the three-comma-club requires calculated moves of favorable circumstances and, “athletes need to get really lucky.”

But that seems hardly the case for Jordan, who had tremendous success as soon as he entered the NBA.

For example, when the first Air Jordan sneaker was released in 1985, Nike reportedly expected to sell $3 million worth of merchandise. Two months later, the brand had $70 million in sales, and $100 million by the end of the year. Initially, Jordan had signed on for five years, earning $500,000 in royalties. In its latest annual report, Nike reported that Jordan was the strongest performer in its divisions, with a 6% sales gain to $6.6 billion in annual revenue for the Jordan Air Brand, 28.6% up from the year before.

Nike wasn’t the only company capitalizing on Jordan’s talent and skill.

Marc Ganis, president of the consulting firm Sportscorp, said “He was a brand before people discussed human beings being brands, actually, it wasn’t Michael Jordan promoting Gatorade; it was Gatorade saying, ‘Drink Gatorade to be more like Michael.’”

“He was a sponge,” says Leonsis, who recalls Jordan being very curious and asking lots of questions. From advertisements to selling sponsorships, Leonsis imparted what Michael knew about the business of sports. “Ultimately, he was more right than I was, which was if you have a great team and you have star players, it’s easy to sell tickets, suites, and sponsorships.”

Sports Business Franchise

Shortly after his 1998 second retirement from the NBA, Jordan started to transition away from life as a celebrity sportsman. According to ESPN, he made unsuccessful bids to buy the Hornets (a team that later became the New Orleans Pelicans) and the Milwaukee Bucks. Jordan eventually joined a Leonsis-led ownership group that bought the NHL’s Washington Capitals and 44% of the Washington Wizards, and he assumed the role of president of basketball operations under the latter’s, then-majority owner, Abe Pollin.

Jordan’s two-season return to the court meant divesting his ownership stake, and when he retired for a third and final time in 2003, he didn’t wait too long to buy another team.

Selling Hornets at $1.5B

In 2006, Jordan purchased a minority stake in the Charlotte Bobcats and, four years later, became the NBA’s first player-turned-majority-owner in a deal mostly leveraged by debt that valued the franchise at $175 million, a considerable drop from the initial $300 million BET founder Robert L. Johnson paid for the expansion of the team in 2003.

Despite his ultra-competitive nature, success on the court never followed for Jordan’s Hornets, the team dropped the Bobcats moniker in 2014 and lost in the first round of the NBA playoffs three times in 13 years.

However, that didn’t stop Jordan from riding a wave of rapidly appreciating sports franchises. In 2019, he sold 20% to Melvin Capital founder Gabe Plotkin and D1 Capital founder Daniel Sundheim, at a $1.5 billion valuation.

The team eventually sold for double that price when Jordan ceded majority control to Plotkin and hedge fund founder, Rick Schnall. Only the Phoenix Suns have sold at a higher price in NBA history for a whopping $4 billion valuation when United Wholesale Mortgage CEO Mat Ishbia bought the franchise in 2022.

Jordan retained a small stake in the Hornets, which will keep him connected to basketball while he searches for his next business investment.

Michael Jordan’s Business Ventures

Over the years, Jordan has ventured into other businesses, including premium tequila brands, car dealerships, restaurants, and, most recently, equity investments. He’s bought into CLEAR, Dapper Labs and Mythical Games, DraftKings, and Sportradar, to name but a few.

In 2020, Jordan cofounded the Cup Series 23XI Racing team with racing driver Denny Hamlin and Joe Gibbs.

“I bet you it’s going to end up being a great business for him, too,” Leonsis says. “It’s his competitiveness and desire to win.”

Shoe Business

In August 2020, the first Nike Air Jordan 1 High shoes were sold for $615,000 at an auction, the same pair of shoes cost $65 in 1985.

In 2021, a 1984 Nike Air Ships pair signed by the basketball star sold for a record $1.5M at Sotheby’s.

“To present such a groundbreaking and important pair of sneakers at this special auction in Las Vegas further solidifies the strength and broad reach of the sneaker collecting community.” Said Brahm Watcher, head of Sotheby’s streetwear and modern collectibles department.

The signed sneakers are from Jordan’s fifth NBA game and set a record for sneakers to crack the 1M dollar mark at an auction.