If you were recently employed or got a pay rise to reach a Ksh.30,000 monthly salary, you must figure out how to balance your earnings and expenses.

First, Ksh.30,000 is a decent starting salary in most companies and may be sufficient for a one-person household. However, if you have a family and school-going children, you must go the extra step to manage your expenses and find ways to earn an extra income to meet your needs.

With the rising cost of living, it’s essential to allocate your income wisely to cover necessities, save for the future, and still enjoy a decent quality of life.

Here’s a comprehensive guide to help you budget effectively.

1. Determine your net income

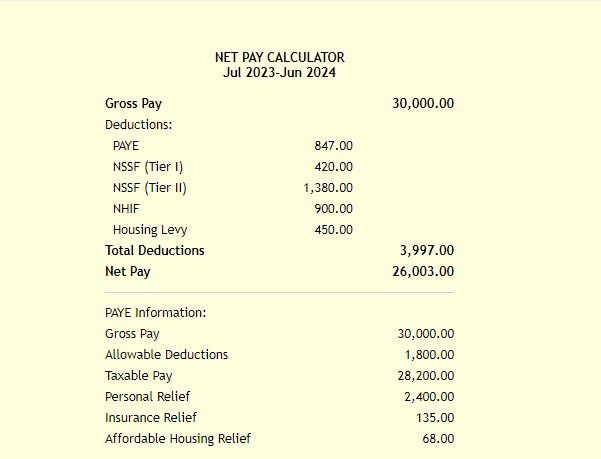

If you earn a gross salary of Ksh.30,000, you must determine how much income will remains after applying statutory deductions. Salaried workers must pay various statutory deductions, including NSSF, NHIF, Housing Levy, and PAYE.

Based on Aren Net Pay calculator, a person earning Ksh.30,000 will have a net income of Ksh.26,003 as of 2024.

2. Prioritize your expenses

Once you have figured out your net income, you should list your essential expenses in order of priority.

A good rule of thumb to allocate money to your expenses is the 50/30/20 rule. This rule allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Here is a guide on how to allocate money to each expense using the above rule

a) Needs (50%) – Ksh 13,000

Rent

Aim to spend no more than 30% of your net income on rent. This means that you should not spend more than Ksh.7,800 on rent. If you are in Nairobi, you can find a bedsitter, double-room, or a one-bedroom for about Ksh.7,000 in the outskirts of the capital.

Some potential estates could be along Thika road or Mombasa road, where daily transport could be Ksh.100 per day. Consider living in more affordable neighborhoods or sharing accommodation.

Sharing accommodation could help you reduce the rent you pay to about Ksh.5,000, saving about Ksh.2,800 for other expenses.

Utilities

Allocate approximately Ksh.1,500 for electricity, water bills, and other utilities. Some rental units may include water bills as part of the rent, meaning that you won’t pay an extra cost for water.

Food

Budget around Ksh 3,000 for groceries. This requires careful planning, cooking at home, and avoiding eating out frequently. Consider buying groceries in bulk, enough to run you through the month.

Some city dwellers have managed to cushion themselves from the high food prices by getting dry food deliveries from their rural homes. Bringing in food items like maize, beans, potatoes, beans, and bananas can significantly reduce your monthly bills.

Transport

Set aside around Ksh.2,000 for public transport, and take advantage of off-peak times to avoid fare hikes.

For example, early morning buses may charge Ksh.30 instead of Ksh.50, which can save you Ksh.20, which could add up to a significant amount at the end of the month.

b) Wants (30%) – Ksh.7,800

Entertainment: Limit spending on leisure activities such as movies, dining out, or other forms of entertainment to around Ksh.2,000.

Personal Care: Allocate about Ksh.2,500 for personal care items and services like nails, toiletries, and hair care.

Miscellaneous: Reserve Ksh.3,300 for other discretionary spending, such as clothes, gifts, or hobbies.

c) Savings and debt repayment (20%) – Ksh.5,200

Savings: Aim to save at least Ksh.3,000 monthly. Open a savings account or use mobile banking savings platforms like M-Shwari or KCB M-Pesa to stash aside some savings. You should also consider putting money in a money market fund to earn interest on short-term investments.

Emergency Fund: Set aside Ksh.1,000 for an emergency fund. This will help you manage unexpected expenses without disrupting your budget.

Debt Repayment: Use the remaining Ksh.1, 200 to pay off any existing debts. Prioritize high-interest debts to save on interest payments in the long run.

3. Track your spending

Regularly tracking your expenses is crucial to ensure you stick to your budget.

Use budgeting apps Good Budget, Budget Simple, and Centonomy Spending Tracker to monitor your spending. Alternatively, maintain a spreadsheet or a written record of your expenses.

4. Cut unnecessary expenses

Identify areas where you can cut back. For instance, reduce dining out, opt for cheaper entertainment options, and buy items in bulk to save on groceries.

Look for discounts and take advantage of promotions.

5. Plan for irregular expenses

Some expenses don’t occur monthly, such as medical bills, school fees, or maintenance costs.

Allocate a portion of your savings towards these irregular expenses to avoid financial strain when they arise.

6. Create a side hustle for extra income

If your salary is not sufficient to cover your needs and wants, consider finding additional sources of income.

You can learn a new skill like writing, social media management, coding, etc., and find freelance work to earn an extra income. You can also start a small side business like cleaning, selling second-hand clothes, or a food kiosk to earn additional income.

Conclusion

Budgeting a Ksh.30,000 salary in Kenya requires discipline, careful planning, and regular monitoring. Whether you are a new or old employee, you should figure out how to make the money fit into your budget. By prioritizing essential expenses, cutting unnecessary costs, saving diligently, and seeking additional income, you can manage your finances effectively and work towards financial stability.