M-Shwari has become one of the most convenient and reliable mobile loan services for Kenyans.

Offered by Safaricom in partnership with NCBA Bank, it allows users to save and borrow money directly from their M-Pesa accounts. However, unlocking your M-Shwari loan limit or increasing it can be tricky, especially if you’re new to the service or aren’t sure what factors influence your limit.

This guide will explain what M-Shwari is, how to unlock Mshwari loan limit, and and how increase your loan limit.

If you are stuck with a zero Mshwari limit or want to raise your borrowing capacity, this article provides practical tips to help you maximize your M-Shwari experience.

What Is M-Shwari?

M-Shwari is a digital savings and loan service accessible through Safaricom’s M-Pesa platform. It enables users to save money securely while earning interest and access quick loans without the need for lengthy application processes or guarantors.

Launched in 2012, M-Shwari is particularly popular because of its simplicity and accessibility. Users can deposit and withdraw funds directly from their M-Pesa accounts, making it a seamless experience for anyone with a Safaricom line.

The service has empowered millions by providing quick financial solutions, especially during emergencies.

M-Shwari Loan Limit

The M-Shwari loan limit refers to the maximum amount you can borrow at any given time. This limit varies from user to user and is determined by your financial behavior, such as your M-Pesa transactions, savings habits, and loan repayment history.

New users often start with a low or zero limit, which increases over time as they build trust with the system. Factors such as consistent savings, frequent M-Pesa activity, and timely loan repayments influence how quickly your loan limit grows.

How to Unlock Mshwari Loan Limit: Steps

Activating your M-Shwari loan limit is straightforward:

Sign up for M-Shwari

- Dial *234# and select M-Shwari or access it through the M-Pesa app.

- Accept the terms and conditions to activate your account.

Make frequent M-Pesa transactions

Use M-Pesa for transactions like sending money, paying bills, and buying airtime. These transactions contribute to building your creditworthiness.

Save money in your M-Shwari account

Deposit small amounts regularly into your M-Shwari savings account. This demonstrates financial responsibility and helps activate your loan limit.

Why Is My M-Shwari Limit Always Zero?

Having a zero loan limit on M-Shwari can be frustrating, especially if you need quick cash. Here are common reasons why this might happen:

Low M-Pesa Activity

If you rarely use M-Pesa, the system doesn’t have enough data to assess your creditworthiness.

No Savings Record

Saving regularly in your M-Shwari account signals financial responsibility. Without savings, your limit might remain at zero.

Poor Loan Repayment History

If you’ve defaulted on previous loans or delayed payments, your limit may be reduced to zero as a penalty.

Incomplete Registration

Ensure that your M-Shwari account is fully activated and linked to your M-Pesa account.

How to Get M-Shwari Loan Instantly

Getting an M-Shwari loan instantly is simple:

Dial *234# or use the M-Pesa app

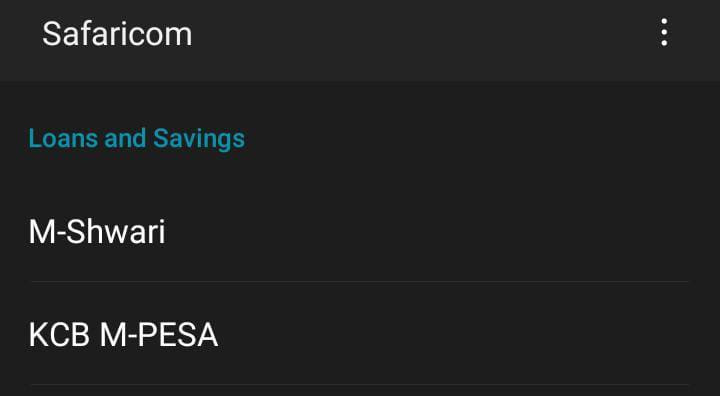

Select Loans and Savings and choose M-Shwari.

Enter the amount you want to borrow (up to your loan limit).

Meet the Basic Requirements

Ensure your account is active, and you have some savings in your M-Shwari account.

Your M-Pesa account must have sufficient funds to cover the loan facilitation fee.

Confirm and Receive Funds

Once approved, the loan amount is credited to your M-Pesa account within minutes.

How to Increase Your M-Shwari Loan Limit

Increasing your M-Shwari loan limit requires consistent effort. Here are some tips:

Use M-Pesa Regularly

Make frequent transactions like sending money, paying bills, and buying airtime. This builds your transaction history and boosts your limit.

Save Regularly in M-Shwari

Deposit money into your M-Shwari savings account consistently. Even small amounts add up and demonstrate financial responsibility.

Repay Loans on Time

Always repay your M-Shwari loans before or on the due date. Timely repayments are a significant factor in increasing your limit.

Avoid Defaults

If you’ve defaulted before, clear your outstanding balance and maintain good financial behavior to rebuild your limit.

Can M-Shwari Deduct Money from M-Pesa?

M-Shwari can deduct money from your Mshwari savings if you fail to repay your loan within the prescribed period.

Here’s what happens when you delay repaying your M-Shwari loan:

Loan Rollover and Fees

If you do not repay your loan within 30 days, the loan is rolled over for an additional 30 days. The rollover includes the outstanding amount and the facilitation fee. Additionally, a 7.5% rollover fee is charged on the loan’s outstanding balance.

For example, if you borrow Ksh. 1,000 and fail to repay within the first 30 days, you’ll owe Ksh. 1,150 in the second month (Ksh. 1,075 plus a Ksh. 75 rollover fee).

Account Closure for Long-Term Defaults

If you fail to settle your loan within 60 days, Safaricom may cancel the M-Shwari loan agreement and close your M-Shwari account without notice.

The funds in your M-Shwari deposit account will be held as collateral equivalent to the outstanding loan amount.

Access Restrictions

Defaulters who repay their loan late will not be able to access M-Shwari loans or use services like Okoa Jahazi for 30 days after repayment.

Impact on Loan Limits

- Defaulting for more than 60 days results in a reduced loan limit.

- If you default for more than 90 days, your loan limit is reduced to zero.

- Defaults lasting beyond 120 days can result in your loan eligibility being permanently canceled.

Safaricom’s loan recovery process is automated, meaning there are no debt collectors involved. However, defaulting on your loan has significant consequences for your ability to borrow in the future.

How to Unlock Money from M-Shwari

Unlocking money from your M-Shwari savings or loan involves:

Withdraw from Savings

- Dial *234# and select Withdraw from M-Shwari.

- Enter the amount to transfer it to your M-Pesa account.

Repay Loans to Access Limits

Clear any outstanding loans to unlock your borrowing limit.

Build Creditworthiness

Follow the steps above to increase your loan limit and unlock additional funds.

Conclusion

Unlocking and increasing your M-Shwari loan limit requires consistent financial discipline and smart usage of Safaricom services. By saving regularly, using M-Pesa frequently, and repaying loans on time, you can gradually increase your borrowing capacity.

Remember, M-Shwari is designed to reward good financial behavior. Stay consistent, monitor your loan limits, and use these tips to make the most of this valuable service. Whether you need a quick loan or want to grow your savings, M-Shwari provides the flexibility to meet your financial needs.