President Ruto-led team has dropped some contentious taxes and levies that have been subject to public debate since the proposals became public.

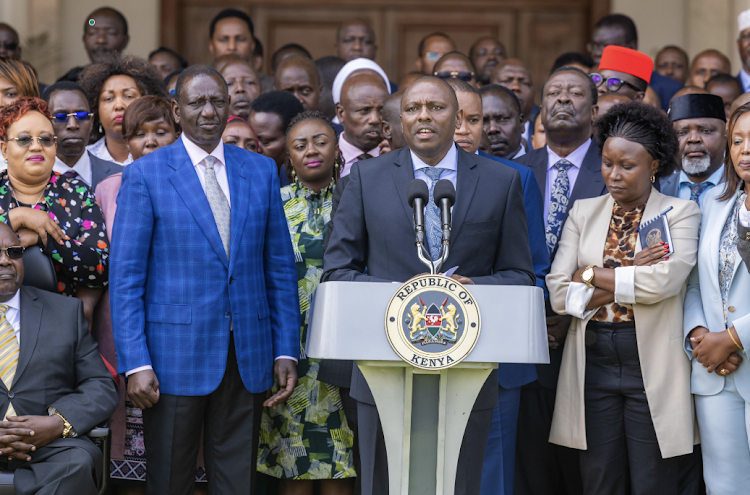

During a press conference held at State House, Nairobi, President Ruto, DP Gachagua, and Kenya Kwanza parliamentarians announced the changes amidst the ongoing public protests against the Finance Bill 2024.

Some of the biggest winners in the new changes are local manufacturers, motor vehicle owners, sugar cane farmers, and consumers of bread.

Here is a highlight of the key taxes dropped in the new changes:

- VAT on bread: The government has removed the proposed VAT on bread, which could have increased the prices of bread by Ksh.10 to 15.

- Tax on mobile money transfers: The government has removed the proposed tax on mobile money transfers, which could have increased the cost of MPESA transactions.

- 2.5% Tax on motor vehicles: The proposed motor vehicle circulation tax has been dropped, which could have added an extra Ksh.20,000 to Ksh.400,000 to annual insurance costs.

- Eco-levy: The government has dropped the eco-levy tax on locally manufactured products, which could have increased the prices of diapers, sanitary pads, wheelbarrow tires, motor vehicle tires, computers, phones, etc.

- Excise duty on vegetable oils: The government has dropped the proposal to apply excise duty on vegetable oils, which could have increased the prices of cooking oil.

- VAT on sugarcane transportation: The government has dropped the proposed VAT on sugarcane transport, which could have increased the prices of sugar.

- Excise duty on alcohol: The government has dropped the proposal to base taxes on alcohol volume and will now base the new taxes on alcohol content.

Other changes announced include making statutory deductions like Housing Levy and Social Health Insurance Fund allowable for tax purposes. This means that these deductions will be excluded from the amount subject to PAYE.

Pensioners will also benefit from the announced changes, with pension income exemptions increased from Ksh.20,000 to Ksh.30,000 per month.

Small-scale farmers and small business owners with total annual incomes below Ksh.1,000,000 will now be exempted from eTIMs registration. This comes after complaints by avocado farmers who were required to produce eTIMs receipts when selling their produce.